Company Overview: AMERCO is a holding company with 4 businesses: 1) Self-Moving 2) Self-Storage (both lumped into the same segment) 3) Property & Casualty Insurance (mostly for trucks) 4) Life insurance. The first two are 90%+ of revenues.

Industry Overview: 40-50mm people move each year. 3/4 will move using Do-It-Yourself. 2/3 of moves are local (important for later). A DIY move will cost less than half of a typical van-line move. A well known fact: Moving is one of the most stressful events of your life.

Competitive Advantage: $UHAL is the indisputable leader in the DIY Moving space. 16X more locations and 8X as many vehicles than its next competitor, Budget, which also retrenched reducing 30% of fleet in the last 10 years. Competitors: Budget, Penske, your friend’s pickup truck.

Network Effects: By having the most locations, U-Haul offers the best convenience. If you’re moving from A to B, you’re likely to have locations near you and the lowest cost (typically). Oh, and they also offer Self-Storage. Would take years and billions to replicate.

Management: Important, because it’s been a family company since founded in 1945. It’s still managed just like one: owns 50% of the company, stays under the radar, does not give guidance, conservative accounting (no adjustments), thinks very long term and has no Wall St. coverage.

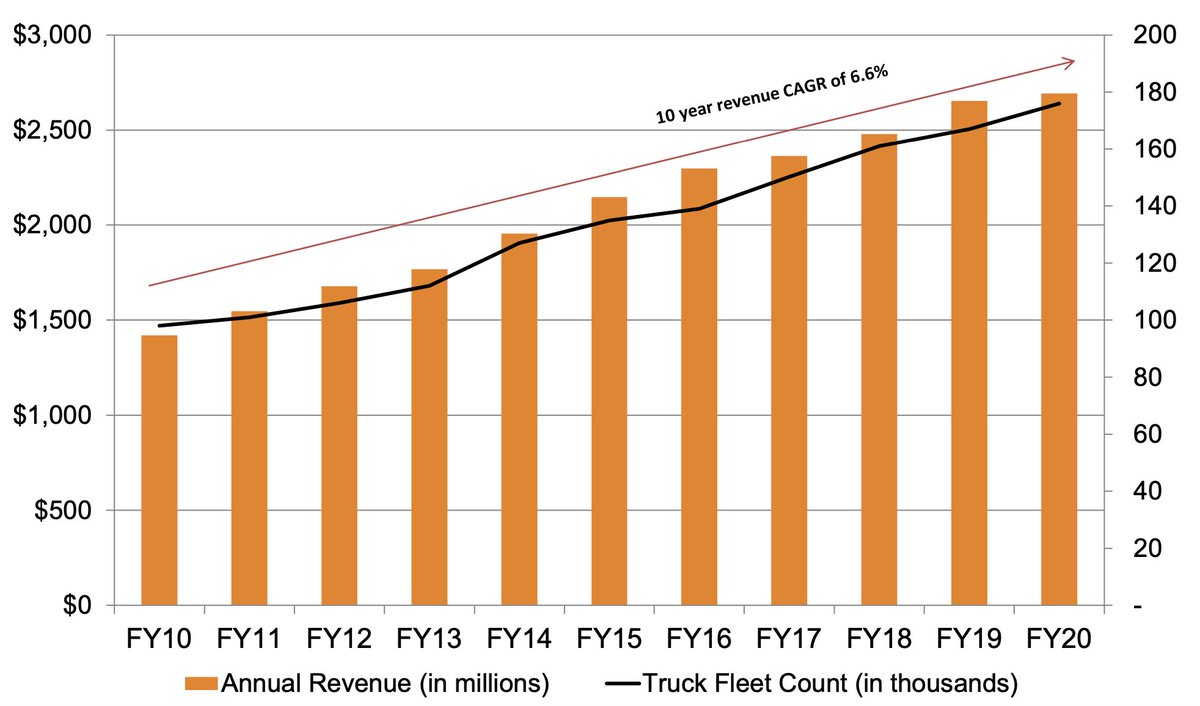

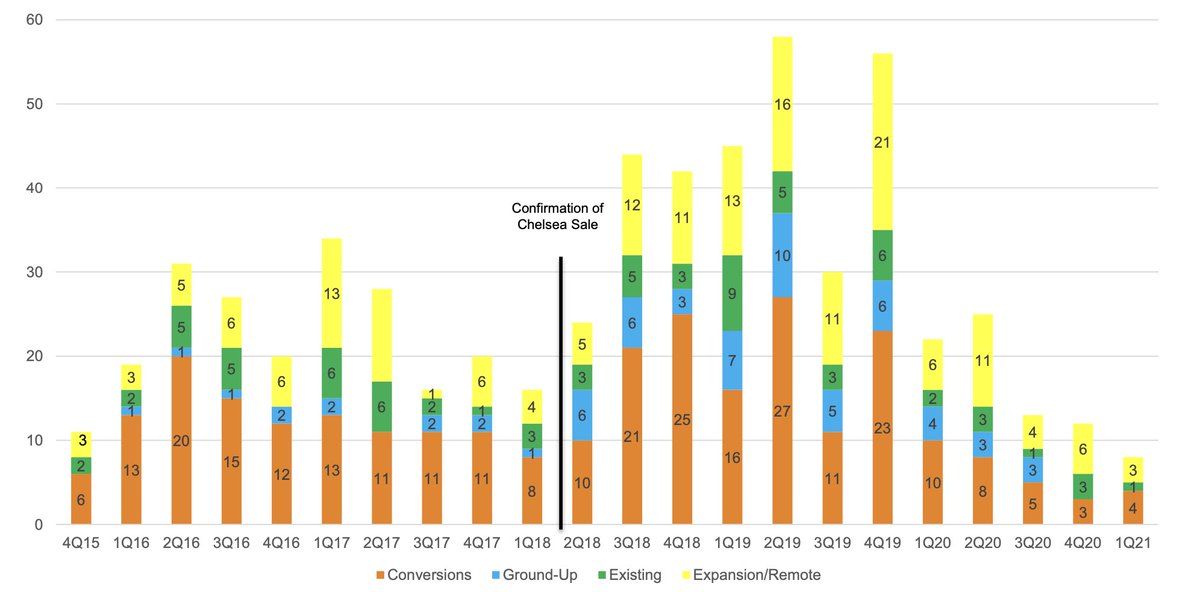

Capital Allocation: All of the FCF gets invested back into the business to expand fleet, locations and aggressively invest in Self-Storage. They are now the second or third largest Self-Storage operator in the US. Why? Revenue synergies between moving and storage.

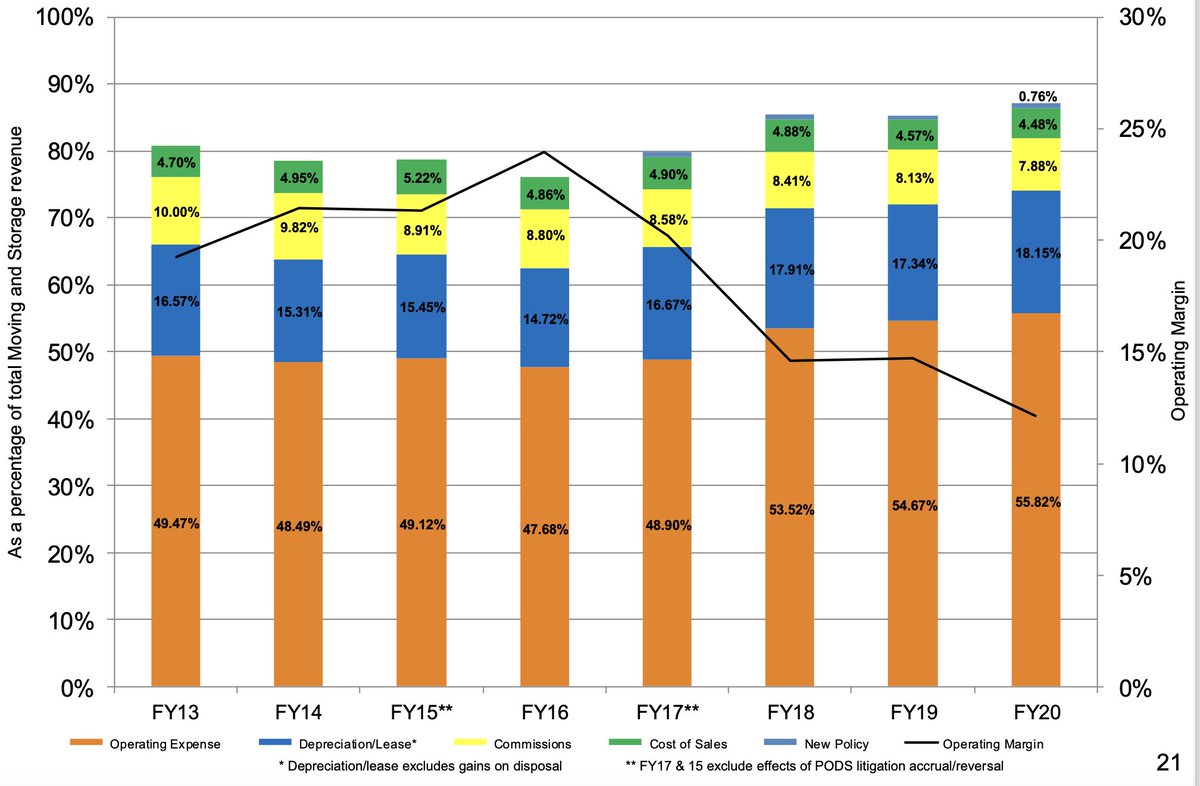

3Q Earnings - A Lesson on Operating Leverage: Self-moving revenues increased 30% y/y. Guess what? people are moving more. But, operating earnings increased 330%. Incremental margins were 85%, in other words for every $1 increase in revenue, 85c dropped to the bottom line.

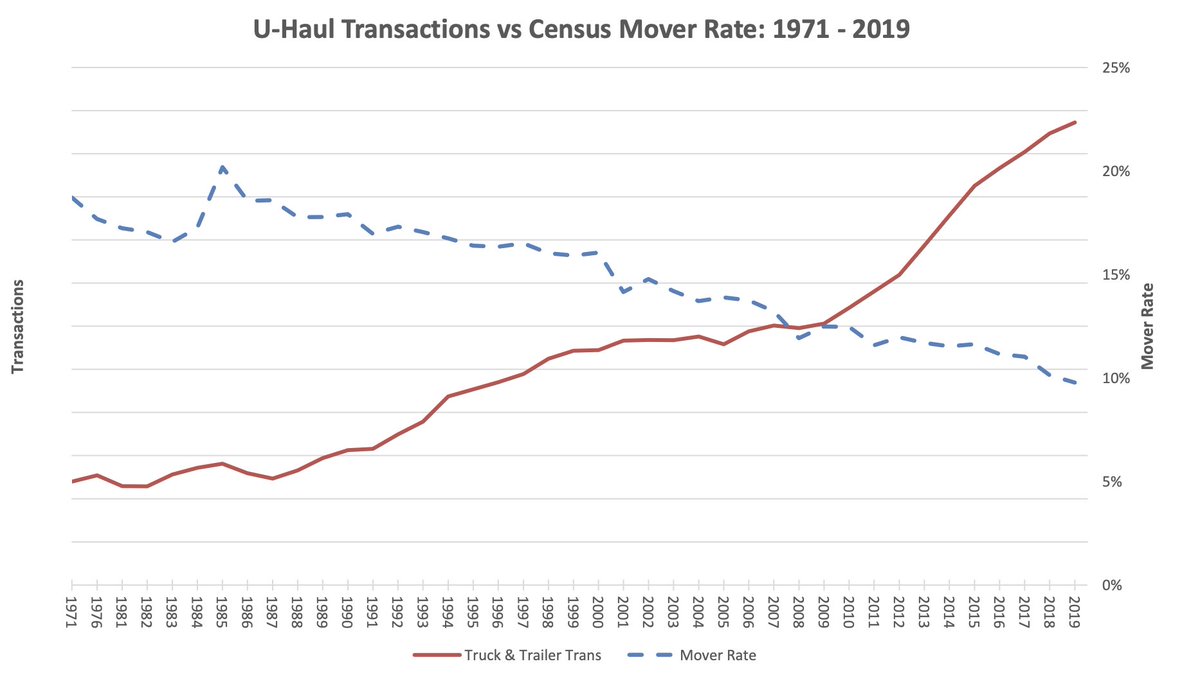

How sustainable is this? Well, the moving rate was at all time lows pre-COVID, and Op margins were also low. This may spark a multi-year moving in & out of cities and cross-state. Also, what happens when many people can work from anywhere? Moving rate may start turning around…

Don’t forget about storage: U-Haul owns 45mm sq. ft. of storage (and 10mm+ in the pipeline). Quick comparison, PSA owns 160mm (3.5x more), and is worth $40B. $UHAL total market cap is less than $10B. Some easy math suggests storage prob worth around 6-7B (using revenue multiples)

Have not done deep valuation or modeling work yet, but can see a scenario where the stock goes +75% from here. A 20% increase in revenues (from fiscal 2020, pre-COVID) and a 23% Op margin (2013-17 avg.) puts normalized earnings at ~$750MM. Is 22X P/E a stretch? I don’t think so

Read on Twitter

Read on Twitter

Will America start moving again?

Will America start moving again?