It's strange that in the uniquely but fleetingly perfect business environment for:

Slack, Docusign, Blue Apron, Spotify, Asana, Carvana, Fivrr, Grubhub,Stitchfix,Door Dash, Box, Palantir, SnapChat, Slack, none of them come CLOSE to making profit and all are "worth" Billions

Slack, Docusign, Blue Apron, Spotify, Asana, Carvana, Fivrr, Grubhub,Stitchfix,Door Dash, Box, Palantir, SnapChat, Slack, none of them come CLOSE to making profit and all are "worth" Billions

The world will never be quite so perfect for Peloton again.

Now worth $43bn

yet by far it's best quarter ever saw profit of $64m

Zoom will face huge competition & Video calls will reduce

Life will NEVER come close to being this perfect

A $125bn company making $186m a qtr ?

Now worth $43bn

yet by far it's best quarter ever saw profit of $64m

Zoom will face huge competition & Video calls will reduce

Life will NEVER come close to being this perfect

A $125bn company making $186m a qtr ?

Wayfair turns profitable for first time, a $29bn company eeking out 173.2m in profit in temporary ideal trading

Pinterest, Snapchat -mature companies with big audiences, that still loose money every single quarter.

"Worth" $50bn, $94bn,losing hundreds of millions of dollars

Pinterest, Snapchat -mature companies with big audiences, that still loose money every single quarter.

"Worth" $50bn, $94bn,losing hundreds of millions of dollars

I get it, the market capitalization is based on years of growth ( and profit) ahead, these companies are tech companies, they own the future, they have network effects, yada yada yada,

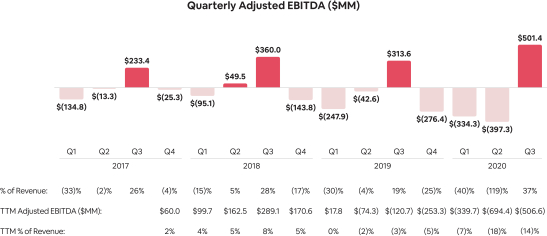

But let's get real and look at Airbnb. A company I admire and like.

But let's get real and look at Airbnb. A company I admire and like.

A company worth 119.14B, with famously no assets, that monetizes spaces.

Worth $30bn more than Marriot,Hilton,IHG,Hyatt,Choice Hotels, Wyndham, combined

Which in it's mature easy stages is loosing money more than half the year.Before sometimes making a few hundred million

Worth $30bn more than Marriot,Hilton,IHG,Hyatt,Choice Hotels, Wyndham, combined

Which in it's mature easy stages is loosing money more than half the year.Before sometimes making a few hundred million

Hyatt hotels has $8.4bn of assets, annual revenue of $5bn ish, makes around a billion in profit most years ( not this) and a mar cap of $7.4bn

Airbnb has no assets, has similar revenue, makes far less money and is worth 18x more because " it's a tech company"

Airbnb has no assets, has similar revenue, makes far less money and is worth 18x more because " it's a tech company"

Carvana is a $50bn technology company that sells cars at a loss, it loses a few hundred million a year, selling about 250,000 cars per year.

CarMax sells 1.3m cars per year, makes $750m+ profit and is worth $20bn

CarMax sells 1.3m cars per year, makes $750m+ profit and is worth $20bn

We should start to ask ourselves what on earth is going on.

Do these companies have any idea what they are doing?

Do investors?

Do they actually have ANY technology at all?

Is the tech actually that helpful to make money?

All I see is utter March 2000 lunacy. In all directions

Do these companies have any idea what they are doing?

Do investors?

Do they actually have ANY technology at all?

Is the tech actually that helpful to make money?

All I see is utter March 2000 lunacy. In all directions

It was bad enough with DTC brands like Allbirds, Casper, Away, being valued like "tech companies", when they are little fads.

It was silly enough with ShakeShack or Blue Bottle as "tech companies"

But these IPO'd public companies collapsing could do rather a lot of damage.

It was silly enough with ShakeShack or Blue Bottle as "tech companies"

But these IPO'd public companies collapsing could do rather a lot of damage.

We're going to look back on $2bn companies on the edge of bankruptcy with zero income, losing market share in historically bad industries like we look at TheGlobe. com now https://www.bloombergquint.com/business/there-s-a-3-000-ev-stock-rally-that-makes-tesla-s-look-meager

Read on Twitter

Read on Twitter