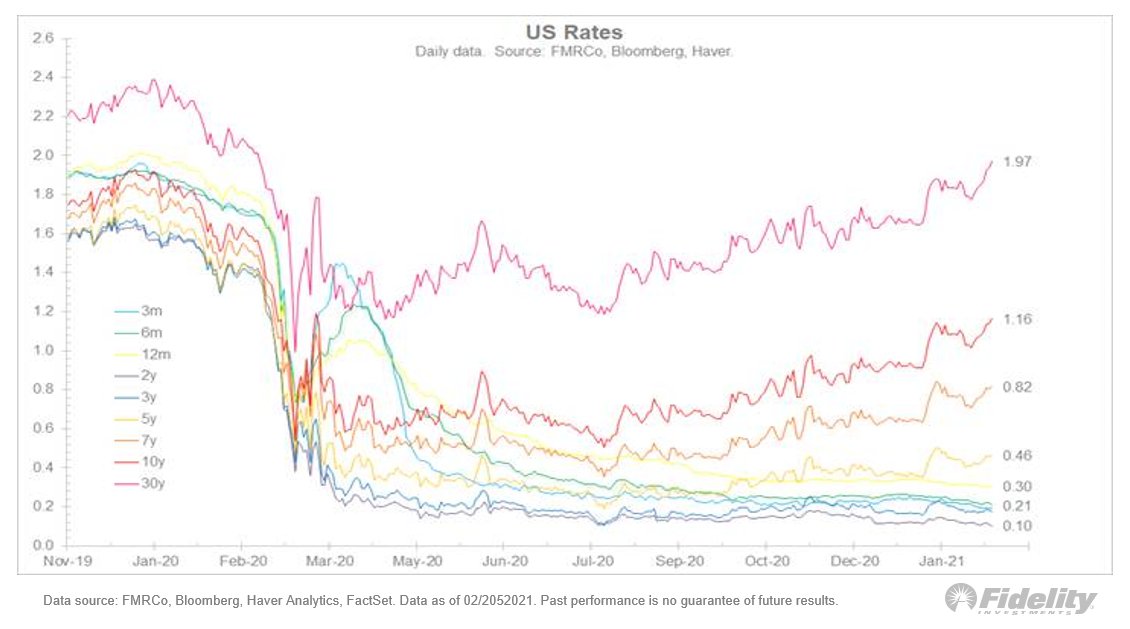

My guess is that #yields will keep pushing higher. If that happens without real rates moving up as well, then the market likely will absorb it in stride. But if real rates climb, too, the #Fed may have to step in to keep rates low. Some underlying data to consider: (1/THREAD)

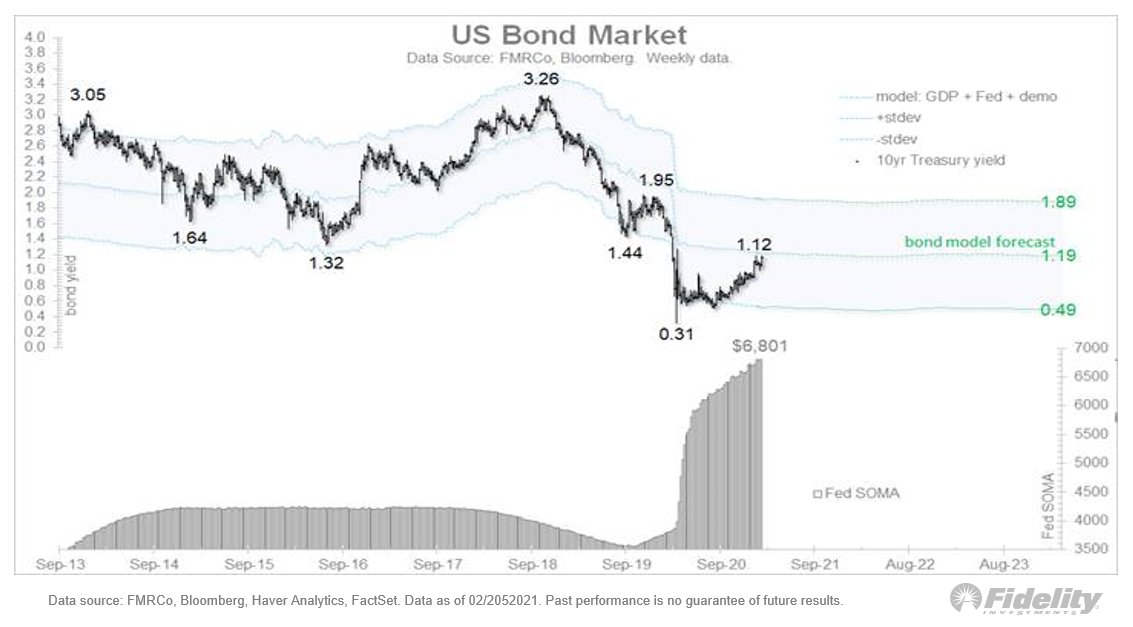

My bond model suggests that the 10-year #yield is right in the middle of its fair-value zone. A move to the upper band would suggest a 10-year of 1.9%. That’s in line with the copper/gold ratio. #bondmarket #bonds 3/

Read on Twitter

Read on Twitter