Sterling has started the year with a bang, smashing through $1.38 against the dollar to its highest level in years.

And there's room for improvement, with analysts predicting it will soon break $1.40.

Why? Here are four reasons (a #thread ) https://www.telegraph.co.uk/business/2021/02/11/sterling-set-hit-145-year/

) https://www.telegraph.co.uk/business/2021/02/11/sterling-set-hit-145-year/

And there's room for improvement, with analysts predicting it will soon break $1.40.

Why? Here are four reasons (a #thread

) https://www.telegraph.co.uk/business/2021/02/11/sterling-set-hit-145-year/

) https://www.telegraph.co.uk/business/2021/02/11/sterling-set-hit-145-year/

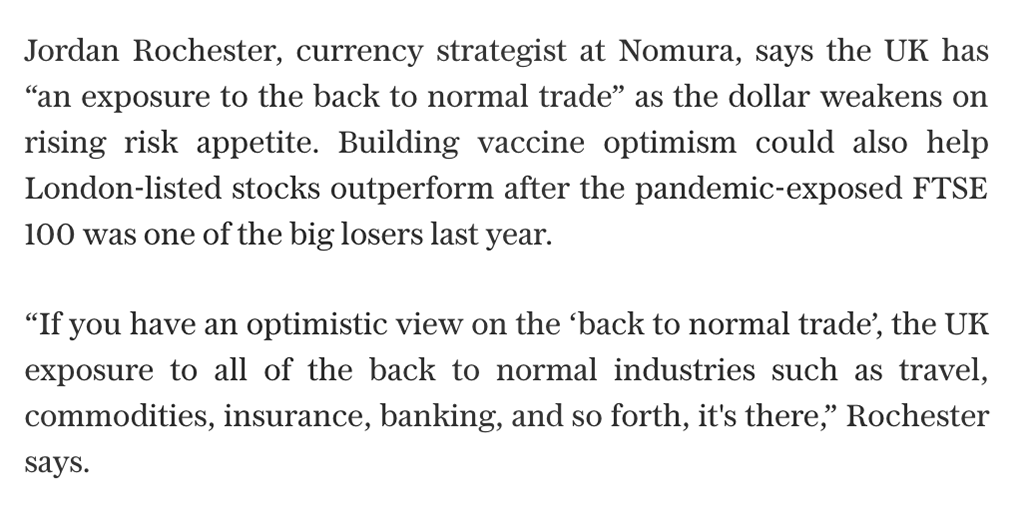

The UK economy and sterling are some of the biggest winners from a rapid vaccine rollout, opening the door to looser restrictions.

Britain has a particular exposure to the "back to normal" trade as the dollar weakens on rising risk appetite, according to @Nomura

Lower interest rates weigh on a country's currency, but a hawkish stance from the Bank of England slashed market expectations of a move to negative rates (and it shows in Gilt yields

).

).Some economists say this has been the "most dominant" driver of the pound's rally…

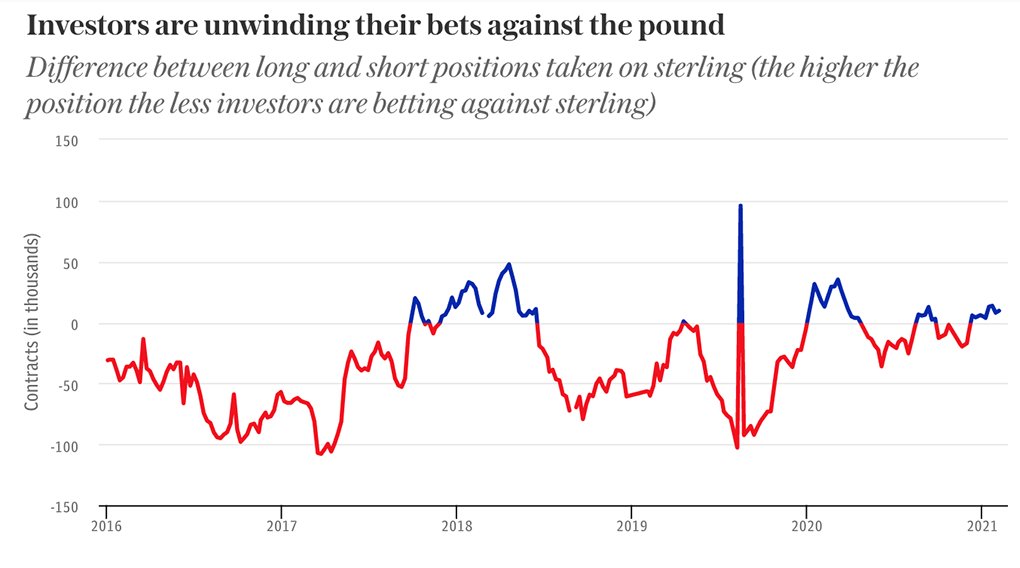

Brexit uncertainty has been the pound's kryptonite since the EU referendum, sending it crashing down to $1.20 at points.

However, the no-deal risk looming over UK assets has been removed and investor confidence is finally recovering

The Government has also stopped building a currency war chest.

The UK had doubled its foreign currency reserves to $90bn+ in recent years, but monthly data shows a dramatic slowdown in Jan 2021 to $37m – down from $3bn added the previous month

That all said, not all analysts believe the Brexit saga is over for the pound.

Read more in @tomelleryrees' analysis here: https://www.telegraph.co.uk/business/2021/02/11/sterling-set-hit-145-year/

Read more in @tomelleryrees' analysis here: https://www.telegraph.co.uk/business/2021/02/11/sterling-set-hit-145-year/

Read on Twitter

Read on Twitter