The divergence between eq and rates vol widened significantly. The 3m10Y swaption vol went through 70 bps yesterday as wrong-footed positioning triggered option-driven selling. Vol is becoming sticky in rates, and that’s worrying. The 1.3% level will trigger more convexity

(1/N)

(1/N)

Related hedging from MBS investors. So we are at a v significant escalation threshold, which explains why the Fed started talking the long end down. 2 other moves lead me to believe that we might have a short-term rally/respite in rates: a- vol seem to have migrated to FX

(2/N)

(2/N)

With the sharp move in the $, probably reflecting some yet to be accounted for flows into UST given the super high yield pick-up for Europeans and Jap. b- breakevens spread to inflation swaps has gone through an important level => breakevens likely to pause/relax a bit

(3/N)

(3/N)

Still a treacherous environment and the bias remains tilted towards some more rates vol medium term. The move so far was very dramatic across all markets (see the EU30Y interest rate swap) and will need to be absorbed

(4/N)

(4/N)

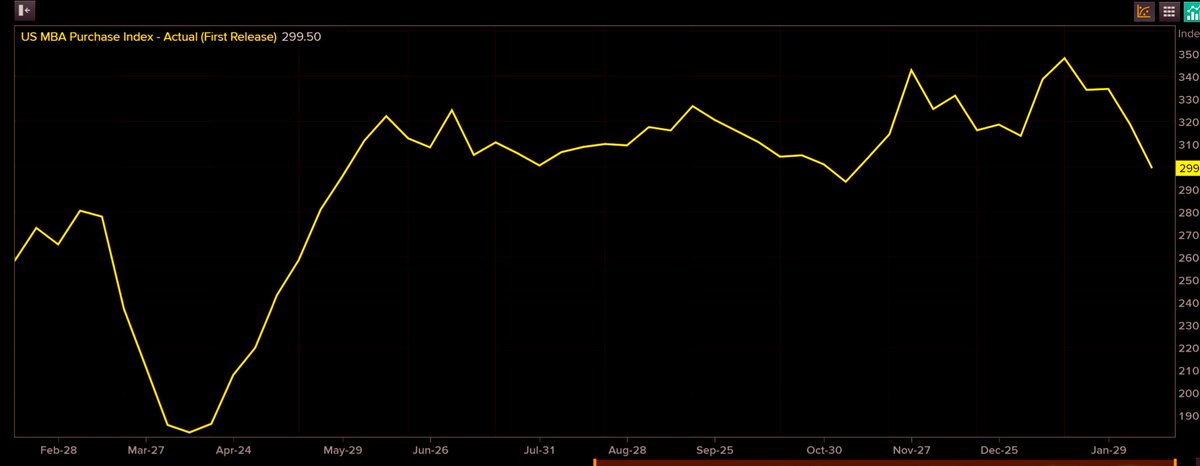

One of the reasons the Fed might be watching closely is that MBA applications have been pressured by the recent steepening. So far, it’s only taking some of the excitement out but beyond 2.2% on the 30Y might start becoming more problematic for the housing recovery

(End)

(End)

Read on Twitter

Read on Twitter